- Attorneys

- Areas Of Practice

- Personal Injury

- Criminal Defense

- ARD Program

- Assault Charges

- Charges Against College Students

- Criminal Record Expungement

- Drug Crimes

- DUI/DWI Charges

- Identity Theft

- Juvenile Criminal Defense

- Murder and Manslaughter

- Offenses Committed on Federal Lands

- Out of State DUI Conviction

- Parole and Probation Violations

- Robbery, Burglary, & Theft Crimes

- Underage DUI

- Weapons Charges

- White Collar Criminal

- Real Estate

- Wills & Estates

- Business Insurance

- Results

- Testimonials

- Blog

- Contact

- Attorneys▼

- Areas Of Practice▼

- Personal Injury

- Criminal Defense▼

- ARD Program

- Assault Charges

- Charges Against College Students

- Criminal Record Expungement

- Drug Crimes

- DUI/DWI Charges

- Identity Theft

- Juvenile Criminal Defense

- Murder and Manslaughter

- Offenses Committed on Federal Lands

- Out of State DUI Conviction

- Parole and Probation Violations

- Robbery, Burglary, & Theft Crimes

- Underage DUI

- Weapons Charges

- White Collar Criminal

- Real Estate▼

- Wills & Estates▼

- Business Insurance

- Results

- Testimonials

- Blog

- Contact

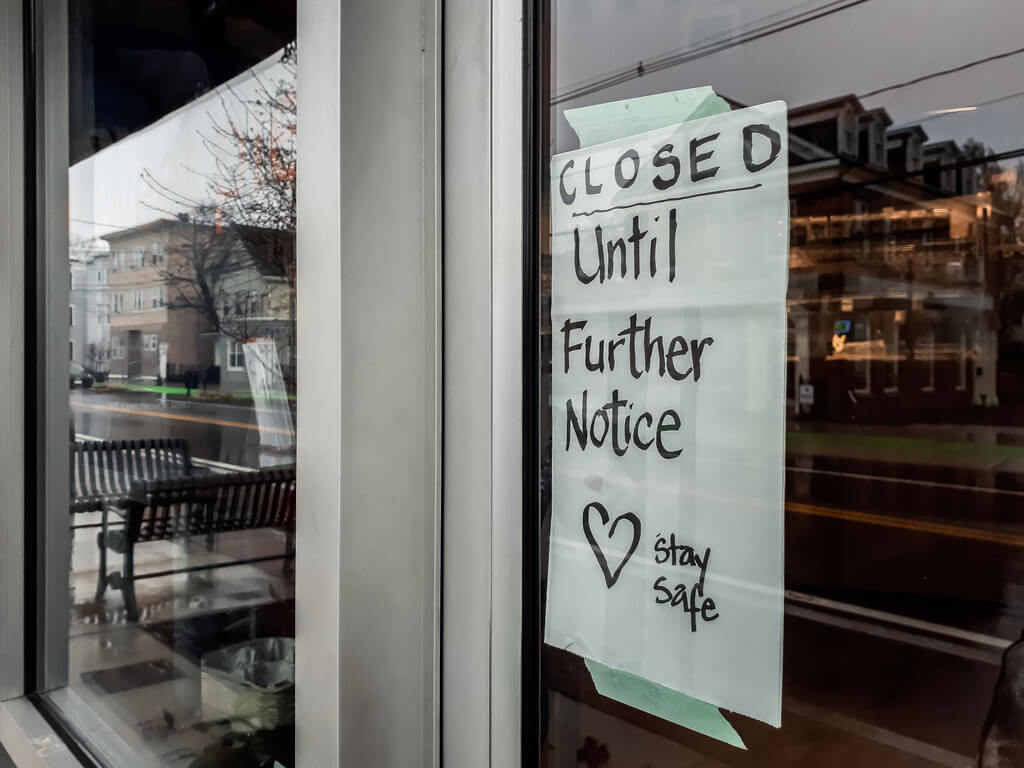

Northeastern Pennsylvania Business Interruption Insurance Claim Attorneys

As a small business owner, you must have small business insurance to cover unknown expenses. Be it a natural disaster, robbery, or even an injured employee, you try to keep your business afloat and your family fed. But when your insurance company denying your claims forces you to shut your doors for months, you may be wondering what options you have. Mazzoni Valvano Szewczyk & Karam is here for Pennsylvania’s small businesses that need someone to handle their business interruption claims.

What Is Business Interruption Insurance?

Business interruption insurance is often a part of a small business owner’s insurance policy. While each policy is different, business interruption policies typically cover economic losses that resulted from unforeseen circumstances.

The conditions typically required for a business loss to be proven are that physical damage to insured property caused by peril resulted in business loss.

Right now, it is estimated that small businesses have lost between $255 billion and $431 billion of income each month as a result of the global health events associated with COVID-19. However, some small businesses in Pennsylvania are still receiving denials of insurance coverage.

What Does Business Interruption Insurance Cover?

When business interruption insurance is applicable, the claim can cover the following:

- Lost Income: In any instance of business interruption, your revenue will likely take a hit. Your insurance needs to pay for any loss of income resulting from the interruption.

- Payroll: Business insurance should also cover your employees’ wages when you’re not bringing in revenue. Talk to a small business lawyer in PA to know how much you can recover.

- Payroll-Related Expenses: Your business interruption insurance policy should reimburse you for all payroll-related expenses during the shutdown period, including compensations, sick pay obligations, vacation, and holidays.

- Normal Operating Expenses: To keep your business running, the insurance claim will cover normal, day-to-day operating expenses, such as office utilities, research, inventory and accounting costs, among other things.

However, policies are different depending on the business. This makes it important to review what your insurance should cover with a business lawyer in Scranton, PA, or an insurance agent.

Pennsylvania Legislation

At the end of May 2020, a new bill was proposed to legislators, providing new information on business interruption coverage claims. This allowed insurance companies to deny coverage based on certain circumstances. Though they are still deliberating, it remains unclear if any legislation will go into effect.

But, in reviewing the emergency motions, the U.S. Supreme Court found the Pennsylvania governor acted within his power to declare a natural disaster as a result of the current health climate. The court called the situation very similar to a natural disaster as it involves “substantial damage to property, hardship, suffering or possible loss of life.”

While this has opened up the possibility that business interruption claims being filed right now by small businesses across the Keystone State may be approved because of the natural disaster declaration, the reality is that it can be highly difficult.

The state is allocating resources for some small businesses throughout the Keystone State. That information is available here. In addition, you can visit Rapid Response Assistance to review material created by the Pennsylvania Department of Labor and Industry and DCED about business interruption claims.

It’s worth mentioning that most business interruption insurance claims are tricky. Since there are several working parts in the process, you need adequate legal representation in your corner to obtain a favorable result. Insurance providers don’t make a profit when they pay out the coverage you pay for, so be ready to fight for the money you’re owed. A small business attorney in PA will guide you in the right direction and help you file and receive the insurance claim you deserve.

What Can Pennsylvania Small Business Owners Do?

Time is of the essence when it comes to these business interruption claims. If your insurance provider has denied your claim, you need legal counsel. Our small business lawyers in PA will view your claim from all sides so you know you’re getting the settlement you deserve.

Many cases can be too complicated for someone to handle on their own. A lawyer will use their experience and knowledge to protect your interests and push your claim along.

At Mazzoni Valvano Szewczyk & Karam, we will review the industry standards of your policy to see if we can appeal your claim.

For some businesses, insurance clauses exist to cover losses as a result of illness. Common businesses that can use these insurance clauses include those in the restaurant and hospitality industry.

That’s why you need a strong legal team behind you. We will review all of the fine print of your insurance policy. In addition, if your insurance provider has not reviewed your claim, it may be possible to open a case. We may also be able to fight for your compensation for canceled events.

FAQs for Business Interruption Insurance Claim Attorneys

1. What Should I Do If My Insurance Company Denies My Claim?

Insurance companies are notorious for denying claims. Also, handling these denials can be a frustrating, time-consuming affair. However, it’s not the end of the road. Here are a few steps you can take to appeal your claim denial and receive the compensation you deserve.

- Once you receive the denial notice, review it to determine why it was rejected. Most claims are denied because they weren’t filed on time, the event isn’t covered, or the insurer suspects fraud.

- Work with a small business lawyer in PA to prepare an appeal clearly illustrating your best arguments and the facts of the situation. If possible, add evidence to support your statements.

- If the insurer still refuses to pay a legitimate claim, you can sue them for acting in bad faith. Bad faith insurance claim denials usually involve intentional attempts to frustrate the insured party.

2. Can I File an Interruption Claim for Utility Outages?

Most business interruption insurance policies differ in their coverage of power or utility outage-related interruptions. Ideally, you should consult a qualified attorney to determine if your policy will cover these damages.

As a rule of thumb, you should be able to claim service interruptions due to power outages and recover ensuing losses. However, there are certain exceptions to this rule. For example, if the loss of power resulted from equipment failure on your business premises, then you may not qualify for coverage. Again, this can be confusing, so it’s best to consult a seasoned, reputable business insurance attorney as quickly as possible.

Mazzoni Valvano Szewczyk & Karam: PA Small Business Insurance Policy Review

If you have been denied insurance coverage as a result of current events, know that you have rights. At Mazzoni Valvano Szewczyk & Karam, we will review Pennsylvania’s small business owners’ claims and help you seek the compensation you deserve.

You are fighting to keep your business afloat. Let us fight for your legal rights. Contact the business interruption claim attorneys of Mazzoni Valvano Szewczyk & Karam today. We serve and protect small businesses across Northeast Pennsylvania.

For additional information about small business insurance claims, visit our blog.

Put your trust in a law firm that puts your best interests first. We offer a free case evaluation to all potential clients.

Contact Scranton NEPA Lawyers

Mazzoni Valvano Szewczyk & Karam

Free Consultation. No Obligation. Fast Reply. Find out how we can help you.